The excellent news is, Credit history Karma can help. You'll be able to log in to the account to view your customized Approval Odds to get a quantity of various charge cards.

Credit Karma strives to deliver a wide array of offers for our users, but our features do not characterize all economic companies, firms or solutions.

A 561 credit rating score can be a indication of previous credit score challenges or a lack of credit history record. Whether you’re searching for a private loan, a house loan or a charge card, credit score scores in this selection may make it tough for getting permitted for unsecured credit, which doesn’t demand collateral or maybe a safety deposit.

Item name, symbol, models, along with other logos showcased or referred to in just Credit history Karma are classified as the home of their respective trademark holders. This great site may be compensated via 3rd party advertisers.

There’s no credit score-setting up benefit to carrying a balance on your playing cards If you're able to find the money for to pay off the total stability Every single billing cycle. In terms of credit history-building approaches, it’s finest to help make dependable rates into the account although retaining the overall total owed underneath 30% within your credit score limit.

The most beneficial style of charge card for your 561 credit rating rating is often a secured credit card. Secured playing cards give individuals with poor credit large approval odds and also have very low charges because cardholders are needed to put a refundable stability deposit. The quantity you set down usually will become your credit limit.

It's also wise to give it time For those who have any factors on the credit history reports which are dragging your scores down. It may be frustrating to possess really hard inquiries display up with your experiences for loans you weren’t even accepted for, but these generally slide off your studies inside of two a long time and may only have an effect on your scores for a single yr.

Make timely payments: Late payments can severely harm your credit scores. Set reminders or automate payments to make sure you stay on track. Even one particular skipped payment can established again your progress significantly.

Your payment record is a crucial component for your credit scores. Having to pay punctually, when on accounts that report back to the a few key shopper credit history bureaus can assist you produce a favourable payment history.

Why? Since You could have an even better likelihood at having accredited to get a retail outlet charge card with bad credit rating. The possible downside is usually that these playing read more cards are inclined to have higher fascination fees, and you may only be able to utilize them at a certain retail store.

And all of that damaging data gained’t tumble off your credit report for seven a long time. So there’s no swift take care of.

If that’s the situation, don’t reduce hope. Comprehension what goes into your credit scores — and Sure, you have got more than one credit score — is The crucial element to setting up your credit.

It’s unlawful for lenders to discriminate depending on particular shielded qualities, such as race, gender, religion or marital position, and there are methods you may take to safeguard your legal rights like a borrower.

Charge cards remain within sight that has a 561 credit rating score, but your options will possible need a bit far more exertion. Secured charge cards are the most typical alternative, since they demand a refundable protection deposit that acts as your credit score limit.

Jaleel White Then & Now!

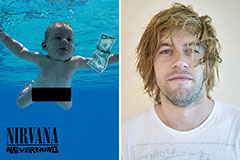

Jaleel White Then & Now! Spencer Elden Then & Now!

Spencer Elden Then & Now! Val Kilmer Then & Now!

Val Kilmer Then & Now! Gia Lopez Then & Now!

Gia Lopez Then & Now! David Faustino Then & Now!

David Faustino Then & Now!